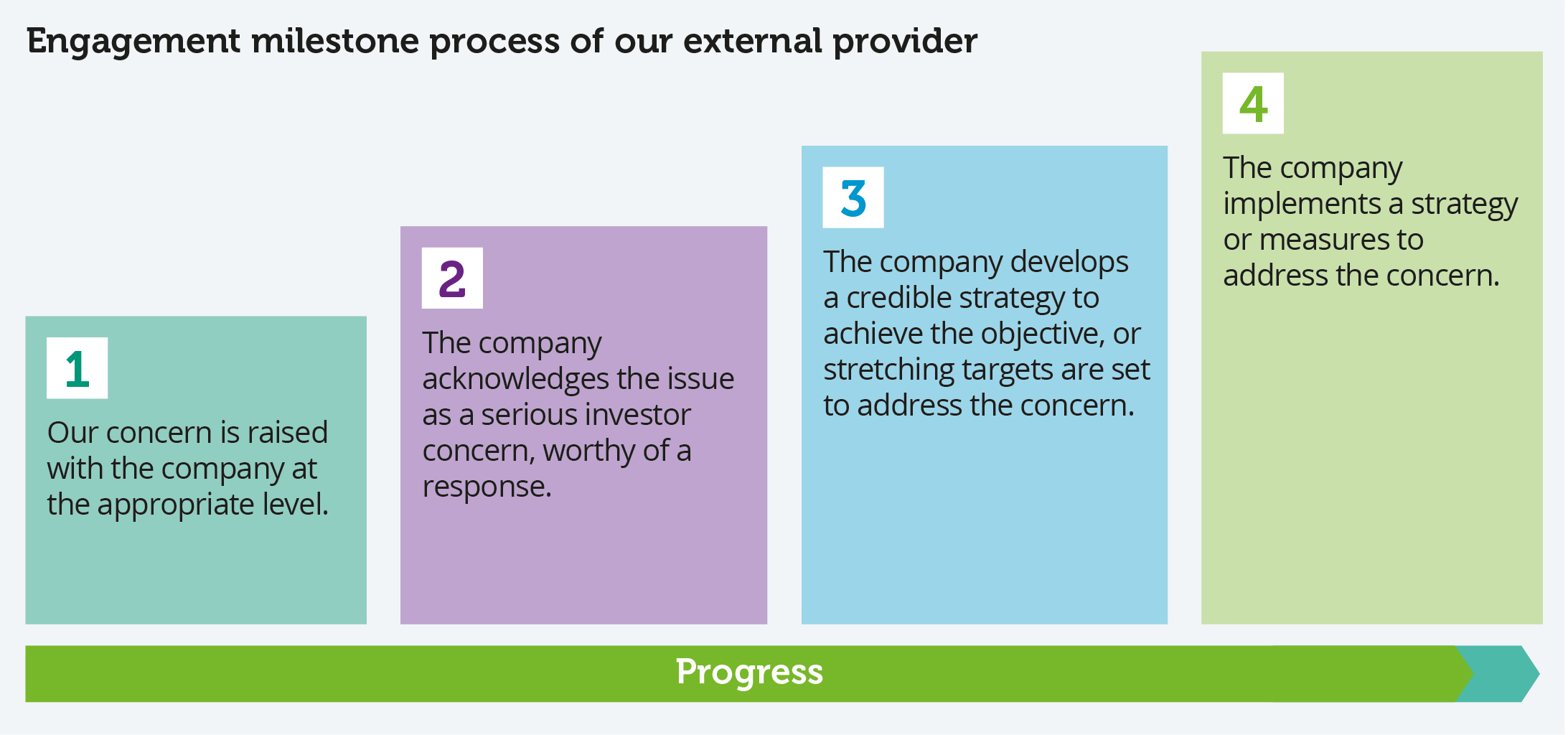

We’ll always seek to exercise our rights as shareholders to vote our ballots, unless it is operationally impractical or prohibitively expensive, for example due to share blocking markets or overly complex Power of Attorney requirements. EOS and, where applicable, our fund managers are instructed to execute all votes for the PPF’s directly held public securities, or explain why any votes have not been cast.

We expect our agents to vote in an informed and non-mechanistic manner, taking all relevant and material issues into consideration, ideally following engagement that has given the company sufficient time to respond. Voting decisions should be based on the spirit of the PPF’s RI strategy and SIP, and should consider best practices set out by the PRI, ICGN and the OECD Principles of Corporate Governance.

Key to all of this is clear and detailed disclosure, without which an informed opinion of the company’s board or governance practices is challenging to obtain. Companies should use their annual reports and accounts to detail their corporate cultures and working practices in a narrative form that relates the way they manage and engage their workforce to their wider strategy and business model. More quantitative performance metrics should also be included (e.g. on diversity, pay ratios, staff training and development, employee engagement and accidents and safety metrics).

EOS takes a pragmatic engagement-led approach to voting our segregated equities as a way of effecting positive change at a company, to protect long-term shareholder value. EOS partners with ISS to leverage on ISS’s extensive resource with regard to voting research, recommendations and execution. However, we are always in control of the vote and have the ability to exercise voting rights in holdings in line with our own policy and principles.

EOS uses proprietary voting guidelines, reflecting their views of best practice globally and the principles outlined in their Engagement Plan, plus regional Corporate Governance Principles tailored to 21 specific markets. EOS’s Regional Corporate Governance Principles can be found in the EOS Library. EOS also uses proxy voting guidelines for 50+ markets (reviewed annually), considering local characteristics and best practice - drawing from the abovementioned Regional Corporate Governance Principles where possible.

Whilst accepting this as the basis for the broad voting policy across our investment portfolio, the PPF will review votes proposed by EOS across key topics prior to them being cast. These key topics are aligned with the voting guidelines issued by the Pensions and Lifetime Savings

Association (PLSA) listed below:

- Board leadership and company purpose

- Division of responsibilities (e.g. separation of chair and chief executive)

- Composition and diversity of boards and executive committee

- Audit, risk and internal control

- Remuneration

- Climate change and sustainability

- Capital structure and allocation

- Company strategy, vision and business model

Where appropriate, and where we consider the issue material but engagement has not been fruitful, we may vote against management on certain resolutions, such as reports and accounts, or election of individual board members with particular responsibility for poor environmental or social performance. We will communicate directly with companies where possible if we have voted against management and we consider the holding to be material (in terms of size in our portfolio, or as a significant shareholder). In addition, where voting forms part of an ongoing engagement with a company or group of companies for a significant issue, we will inform the company management of voting intentions ahead of the AGM.

Alongside purposeful engagement, we will vote for resolutions that reinforce our own stewardship principles, and especially those that are consistent with our Climate Change policy and the goals of the Paris Agreement. Shareholders should propose shareholder resolutions under defined circumstances and for specific issues (e.g. when management has ignored reasonable and persistent requests for change on material concerns to shareholders). In deciding our vote on shareholder resolutions, we will adopt a case-by-case approach, considering the merits of the individual proposal alongside the quality and independence of reports provided by the company and the responsiveness of company management to the dialogue.

Collective action between shareholders can be an effective way to engage with companies on certain issues, and to achieve improvements in corporate governance. We, or our agents on our behalf, will therefore act collectively with other investors as appropriate for an organisation of our size and standing, where we deem that this will improve the value of our investments in the long term. As participants in investor initiatives such as Climate Action 100+ and the Transition Pathway Initiative (TPI), we are constructive of certain shareholder resolutions that encourage appropriate improvements in company management quality and the disclosure of material climate-related financial risks, and progress in terms of carbon performance.

We will produce a separate Voting Guidelines document to be read alongside this Stewardship Policy. The voting guidelines document will be updated on a more flexible basis, to reflect any specific areas of focus in upcoming AGM seasons.

Pooled fund voting:

While our views will generally be aligned with our fund managers’, there may be situations where we want to exercise a different approach on some topics. Where this is the case, and we are able to determine the votes for our shares in a pooled fund, we will take advantage of a split voting set-up, or “override” function. For mandates where we cannot instruct this, we will carry out an ex-post assessment of the manager’s reporting of voting activities for our portfolio across our key topics or most material issues, and will also ask in advance of contentious AGMs of their voting intention (if they are able to share it). We require regular voting report from our managers and will raise any concerns about specific aspects of the manager’s voting actions.