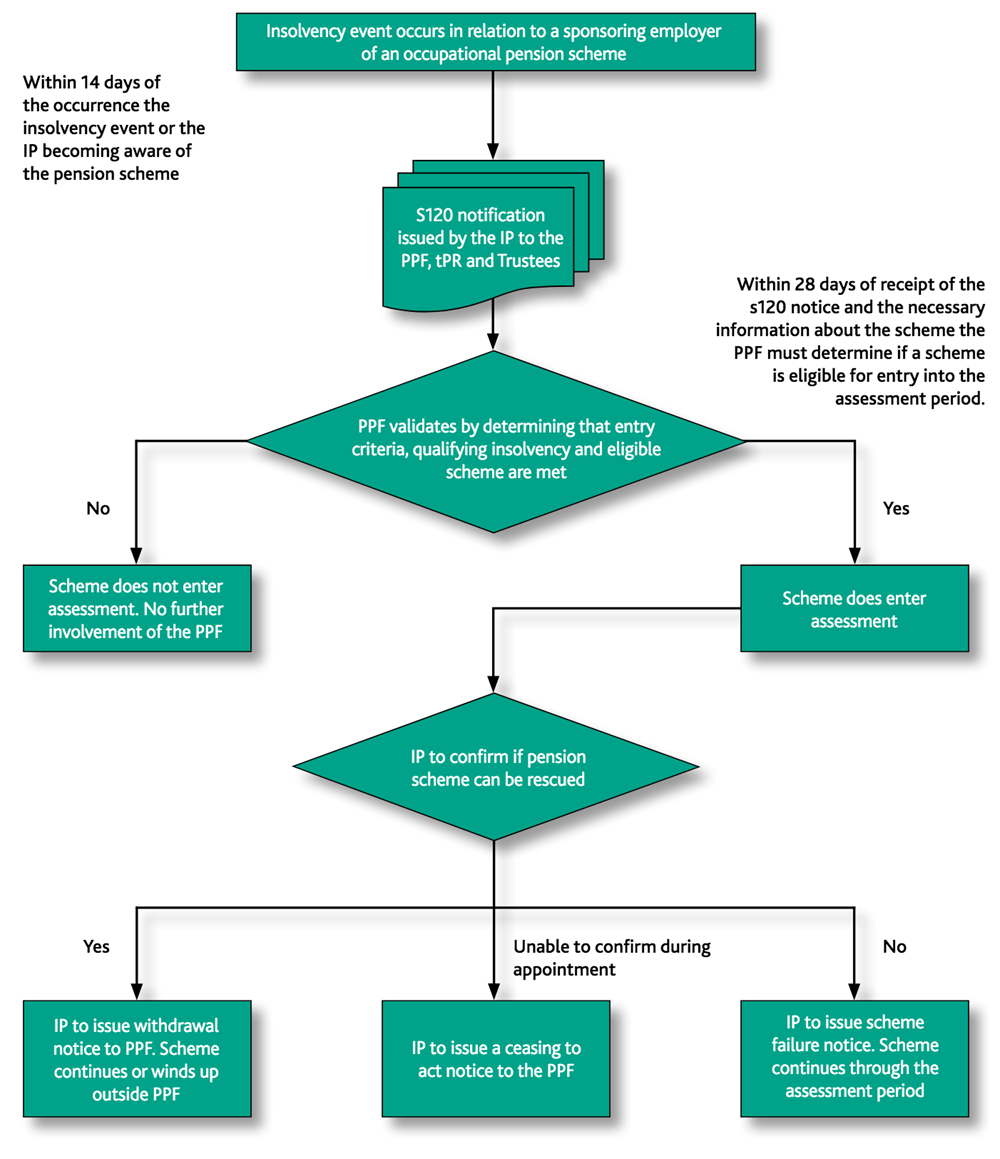

The assessment period starts with a qualifying insolvency event. You must file notice of the insolvency – an S120 notice – within 14 days of your appointment or of becoming aware of the existence of the pension scheme.

Without that, it’s not possible to make a start on the work that needs to be completed during the assessment period. By law, we exercise the trustees’ rights against the employer during the assessment period.

So we need to know about the insolvency as soon as possible.

As an insolvency practitioner you’ll play a key role during the process and work closely with designated members of our Restructuring and Insolvency team throughout.

If you have any concerns at any stage, we’re happy to help.

Your responsibilities during assessment