We manage environmental, social and governance (ESG) risks to protect and enhance the value of our investments.

By acting as a responsible and vigilant asset owner and using our influence as a major institutional investor, we encourage best practice from the top down and bottom-up.

“We believe it’s vital we demonstrate a robust and effective approach to RI, and we see the integration of material ESG issues as an essential part of the investment process.”

Barry Kenneth, Chief Investment Officer

What does ESG mean to us?

Our RI strategy is founded on our two core beliefs:

- By acting as a responsible and vigilant asset owner, we can protect and enhance the value of our investments.

- ESG factors, and especially climate change, can have an impact on the performance of our investments, and the management of these risks and opportunities can add value to our portfolio.

We view ESG factors as the interaction of our investments with:

- the physical environment and climate (Environment)

- communities, workforces, wider society and economies (Social)

- governance structures of the organisations and markets we invest in (Governance)

ESG integration (including but not limited to climate change) is achieved by engaging with and advancing the ESG practices of our external managers and underlying issuers, rather than divesting.

The United Nations Principles for Responsible Investment

We were an early signatory to the United Nation's supported Principles for Responsible Investment (PRI). We use them as guiding principles for our RI strategy, to integrate relevant ESG issues into the analysis of our investments.

We've actively been encouraging all our managers to consider becoming PRI signatories. In 2020/21, 11 of our managers became signatories to the PRI, five of which are large US-based private markets managers.

Our PRI assessment scores:

We were delighted to be awarded A+ scores in eight modules and A scores in the remaining two modules, for the 2020 PRI Reporting Assessment.

Our three key priorities

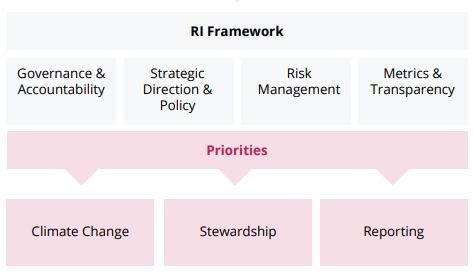

Our RI strategy is put into practice through a robust framework that has three key priorities:

1. Climate change

We have a specific Climate Change Policy that details our commitment to identifying our exposure to and managing climate-related risks relevant to our investments. These risks require proper governance, risk management and close monitoring over time, in line with leading disclosure frameworks such as the FSB’s Task Force on Climate-related Financial Disclosures (TCFD). We publish TCFD disclosures in our Sustainability Report annual report and accounts.

We’re also collaborating with industry peers and the wider investment community on climate change initiatives, including support for the Paris Agreement and the transition towards a low-carbon economy.

Learn more about how we’re assessing and managing the impact of climate change

2. Stewardship

We also have a specific Stewardship Policy that reflects our commitment and approach to active ownership. We exercise our voting rights and engage with the companies and issuers we invest in to make sure they‘re accountable and fulfil their obligations to shareholders and other stakeholders. In addition, we monitor the stewardship activities of our fund managers.

Working together with fund managers, key stakeholders and policy makers allows us to be more effective on the key ESG issues.

3. Reporting

We’re committed to clear and robust reporting and require the same from our managers. We believe in sharing what we’re doing with our members, levy payers and other stakeholders.

We're pushing for greater transparency in reporting across our investment portfolio and the pensions and investment industries. This includes aligning our reporting with best practice guidelines such as the TCFD and the UK Stewardship code.

We support several financial disclosure initiatives on ESG-related issues. We publish regular engagement and voting reports and yearly Sustainability Reports. We also publicly disclose our responses to key consultations.

Learn more and read our reports

How we’re implementing our strategy

We've continued to focus on delivering progress for the three priorities of our strategy. In our Sustainability Report we published our achievements and ongoing evolution for integrating ESG issues across the portfolio.