Climate change is one of the biggest issues on the global agenda. One that has the potential to impact businesses, economies and people everywhere.

We’re actively looking to manage the impact of climate change and its related risks and opportunities through our investment approach. We're committed to:

Read our climate change policy

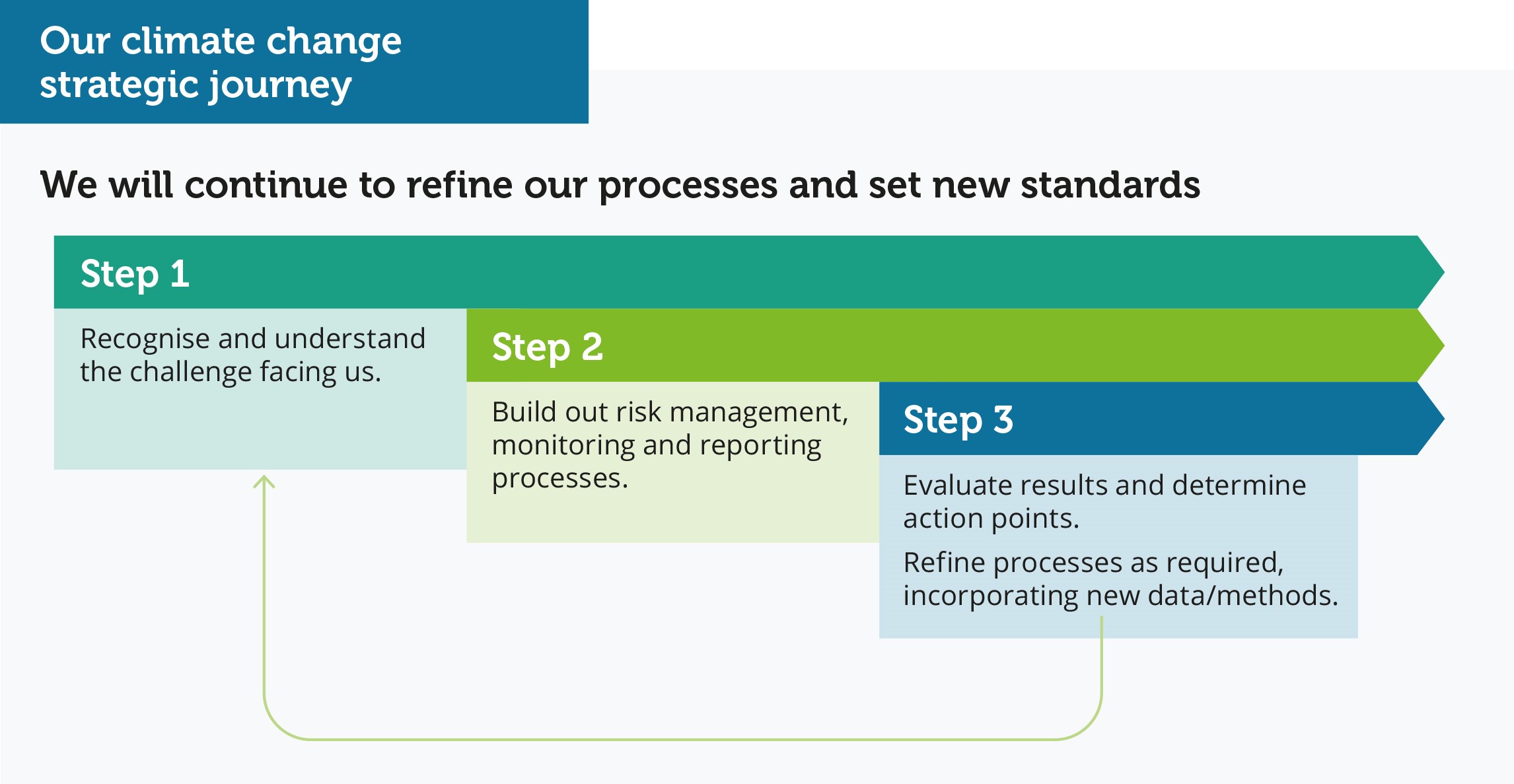

We consider climate risk management as an ever-evolving strategic journey and we continuously look to refine our processes and set new standards. We will continue to take a leadership role as we refine our processes further and set new standards in other asset classes where access to data and tools is still scarce.

Climate change strategic journey

Driving transparency and disclosure

Given the systemic nature of climate change risks, we champion investor organisations that drive transparency in this area and support several disclosure initiatives.

This includes being members of the PRI, CDP, Institutional Investors Group on Climate Change (IIGCC), Climate Action 100+ and the Transition Pathway Initiative (TPI).

We are also a formal supporter of the FSB’s Task Force on Climate-related Financial Disclosures (TCFD).

The TCFD guidance was created to help companies and investors voluntarily disclose climate-related financial risks in a clear, consistent and reliable way to help lenders, insurers, and investors make informed decisions.

Managing climate change risk and opportunity

We’ve started identifying the types of climate-related risks and opportunities that could impact our investments. Certain risks can have different likelihoods or magnitude of impact, depending on the asset class.

Some examples of these risks include:

- Transition – risks that may impact company earnings in the shorter term, such as policy risks arising from carbon pricing or taxes

- Technology – risks and opportunities as companies develop, or do not adopt, superior technology to build industry-based solutions

- Physical – risks in the medium to long-term that may impact assets such as infrastructure and property in certain locations

- Opportunities within some asset classes. This includes sustainable forestry assets that offer a viable nature-based solution to climate change